499r 2w 2pr

I have a 499r2/w2pr from working in puerto rico They have taken federal taxes out as well as medicare taxes, how do i file and must i file if i am not a PR resident?.

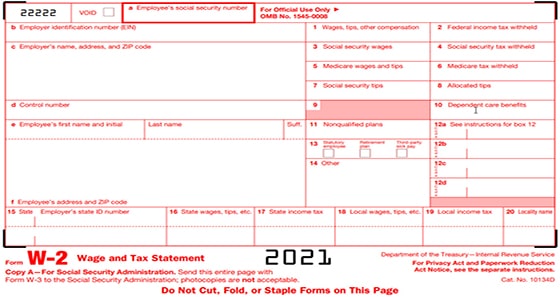

499r 2w 2pr. The format is different than a regular W2 and I do not know how to enter in the information. Form 499R2/W2PR, including all information reported Complete the electronic transfer before the due date in order to avoid late filing penalties Email address is required at RA record, location Reimbursed Expenses includes Fringe Benefits (RS State Record, location ) and (RV State Total Record, location 3347). To print a 499R2/W2PR form From the Reports menu, choose Payroll, then choose Print 499R2/W2PR Forms You cannot display 499R2/W2PR information However, you can display the same information in the yeartodate Employee Summary report.

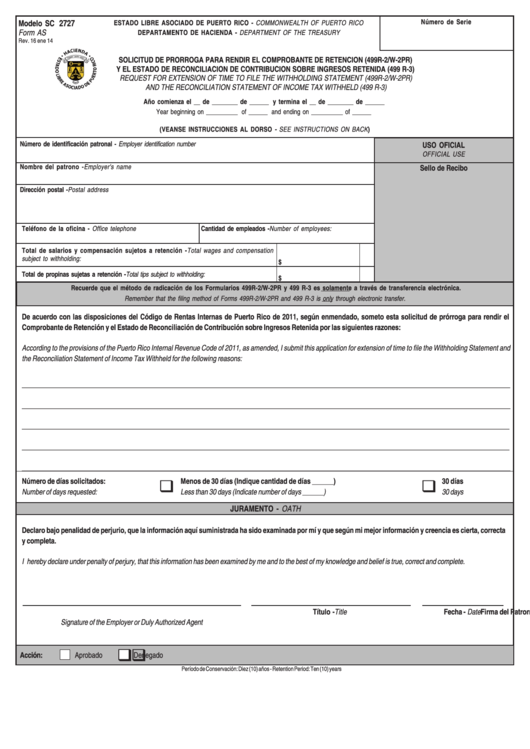

The deadline to file the 19 Form 499R2/W2PR with the Puerto Rico Treasury Department is January 31, A 30day extension is available by filing Form AS 2727, Request for Extension of Time to File the Withholding Statement and Reconciliation Statement of Income Tax Withheld, through SURIThe extension will be made available on the SURI portal after January 1,. The Department of the Treasury has required the electronic filing of Form AS 2727 “Request of Extension of Time to File the Withholding Statement (W2PR) and Reconciliation Statement of Income Tax Withheld (499R3) The electronic application is available through the PRTD’s website. Commonwealth of Puerto Rico Department of the Treasury PUBLICATION 1306 FORM 499R2c/W2cPR ELECTRONIC FILING REQUIREMENTS FOR TAX YEAR 13.

Form 499r2/w2pr Fill Online, Printable, Fillable Blank formw3prcom form 499r2/w2pr Online solutions help you to manage your record administration along with raise the efficiency of the workflows Stick to the fast guide to do Form W3PR, steer clear of blunders along with furnish it in a timely manner. To request an extension of time to file the Withholding Statement (W2PR) and Reconciliation Statement of Income Tax Withheld (499R3) submit an electronic filing of Form AS 2727 The electronic application will be available through SURI Filings in paper form, via fax, mail or any other method will not be considered as filed. 499r2/w2pr Fill Online, Printable, Fillable Blank formw3prcom 499r2/w2pr Online solutions help you to manage your record administration along with raise the efficiency of the workflows Stick to the fast guide to do Form W3PR, steer clear of blunders along with furnish it in a timely manner.

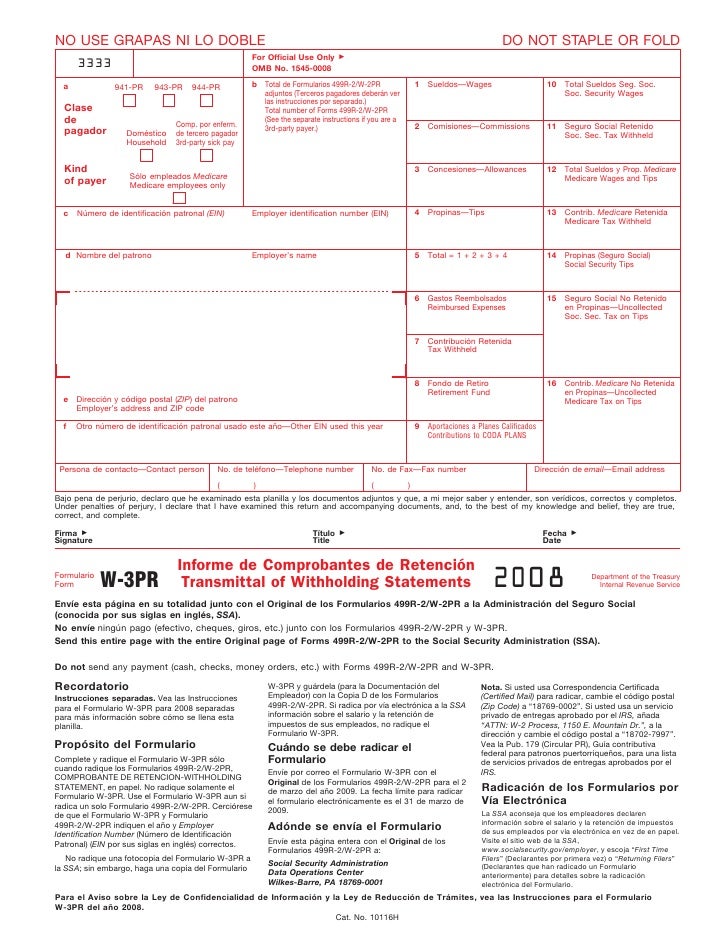

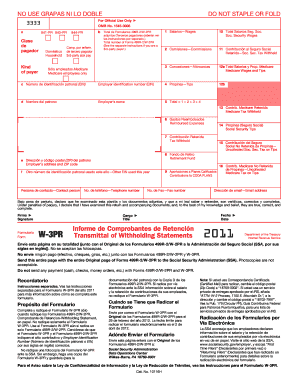

Instructions for filing Form 499R2/W2PR Copy A (W2) information to the Department of the Treasury on magnetic media using the MMW2PR1 format Who must use these instructions?. To request an extension of time to file the Withholding Statement (W2PR) and Reconciliation Statement of Income Tax Withheld (499R3) submit an electronic filing of Form AS 2727 The electronic application will be available through SURI Filings in paper form, via fax, mail or any other method will not be considered as filed. 499R2/W2PR Make sure that both Form W3PR and Form 499R2/W2PR show the correct tax year and employer identification number (EIN) Don’t file a photocopy of Form W3PR with the SSA However, make a copy of Form W3PR to keep with copies of your Forms 499R2/W2PR The IRS recommends retaining copies of these forms for 4 years.

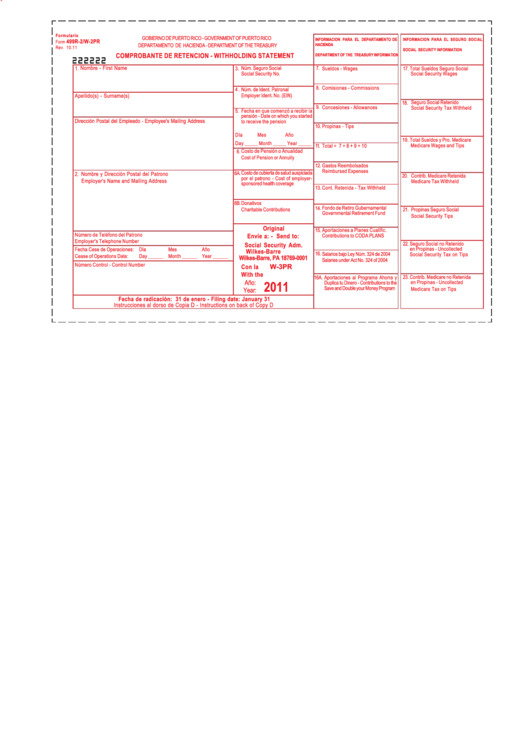

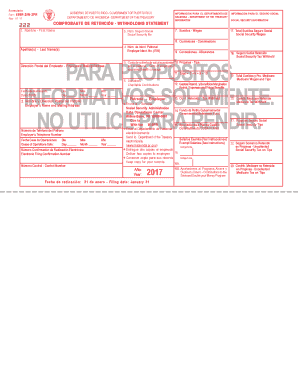

INFORMACIÓN PARA EL SEGURO SOCIAL SOCIAL SECURITY INFORMATION Formulario Form 499R2/W2PR Rev 07 GOBIERNO DE PUERTO RICO GOVERNMENT OF PUERTO RICO DEPARTAMENTO DE HACIENDA DEPARTMENT OF THE TREASURY Fecha de radicación 31 de enero Filing date January 31 Costo de cubierta de salud auspiciada por el patrono Cost of employer. Employers with 5 or more W 2 Forms to submit What if I have 5 or more W 2s and I send you paper W 2s?. The deadline to file the 19 Form 499R2/W2PR with the Puerto Rico Treasury Department is January 31, A 30day extension is available by filing Form AS 2727, Request for Extension of Time to File the Withholding Statement and Reconciliation Statement of Income Tax Withheld, through SURIThe extension will be made available on the SURI portal after January 1,.

You will be penalized by the Department of the Treasury. The same design of printed Form 499R2/W2PR will be used for all purposes to keep a copy for your records and to deliver two copies to the employee The Social Security Wage Base for Tax Year 17 is $127,0 The Contributions to CODA PLANS cannot exceed $24,000. The format is different than a regular W2 and I do not know how to enter in the information.

Therefore, the signNow web application is a musthave for completing and signing form 499r 2 w 2pr on the go In a matter of seconds, receive an electronic document with a legallybinding esignature Get form 499r 2 w 2pr signed right from your smartphone using these six tips Type signnowcom in your phone’s browser and log in to your account. How do I enter WPR?. The format is different than a regular W2 and I do not know how to enter in the information.

How do I enter WPR?. Puerto Rico Releases Form W2PR Filing Rules Nov 9, , 846 PM Puerto Rico’s electronic filing specifications for Forms 499R2/W2PR, Withholding Statement, were released Nov 5 by the territory’s Departamento de Hacienda To read the full article log in. You will be penalized by th e Department of the Treasury.

Puerto Rico Tax Law has special rules as a posession of the US The Tax Institute is explaining what you need to know about filing a Puerto Rico tax return. Treasury Form 499R2/W2PR on behalf of an employer If you have 250 or more W2s and you are going to submit a copy of this magnetic media to the SSA, you must comply with the Agent Determination Rules contained in the Social Security Administration Magnetic Media Reporting and Electronic Filing for Tax Year 02 Booklet Terminating a Business. The deadline to file the 19 Form 499R2/W2PR with the Puerto Rico Treasury Department is January 31, A 30day extension is available by filing Form AS 2727, Request for Extension of Time to File the Withholding Statement and Reconciliation Statement of Income Tax Withheld, through SURI The extension will be made available on the SURI.

Form 499R2/W2PR, including all information reported Complete the electronic transfer before the due date in order to avoid late filing penalties Email address is required at RA record, location Reimbursed Expenses includes Fringe Benefits (RS State Record, location ) and (RV State Total Record, location 3347). Yes, and we encourage you to use these instructions. Instructions for filing Form 499R2/W2PR Copy A (W2) information to the Department of the Treasury on magnetic media using the MMW2PR1 format Who must use these instructions?.

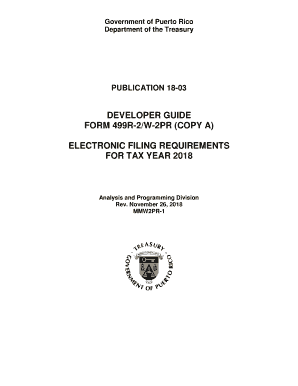

Use this form to transmit Form(s) 499R2/W2PR to SSA Current Revision Form W3 (PR) (in Spanish) PDF About Form W3 (PR), Transmittal of Withholding Statements Internal Revenue Service. Purpose of this Publication To provide the electronic transfer filing instructions for Form 499R2/W2PR Copy A (W2) using the EFW2PR format Users of this Publication Employers submitting Form 499R2/W2PR by text file Mandatory Electronic Filing You must file all employee wages records electronically through SURI using EFW2PR format. The Department of the Treasury has required the electronic filing of Form AS 2727 “Request of Extension of Time to File the Withholding Statement (W2PR) and Reconciliation Statement of Income Tax Withheld (499R3) The electronic application is available through the PRTD’s website.

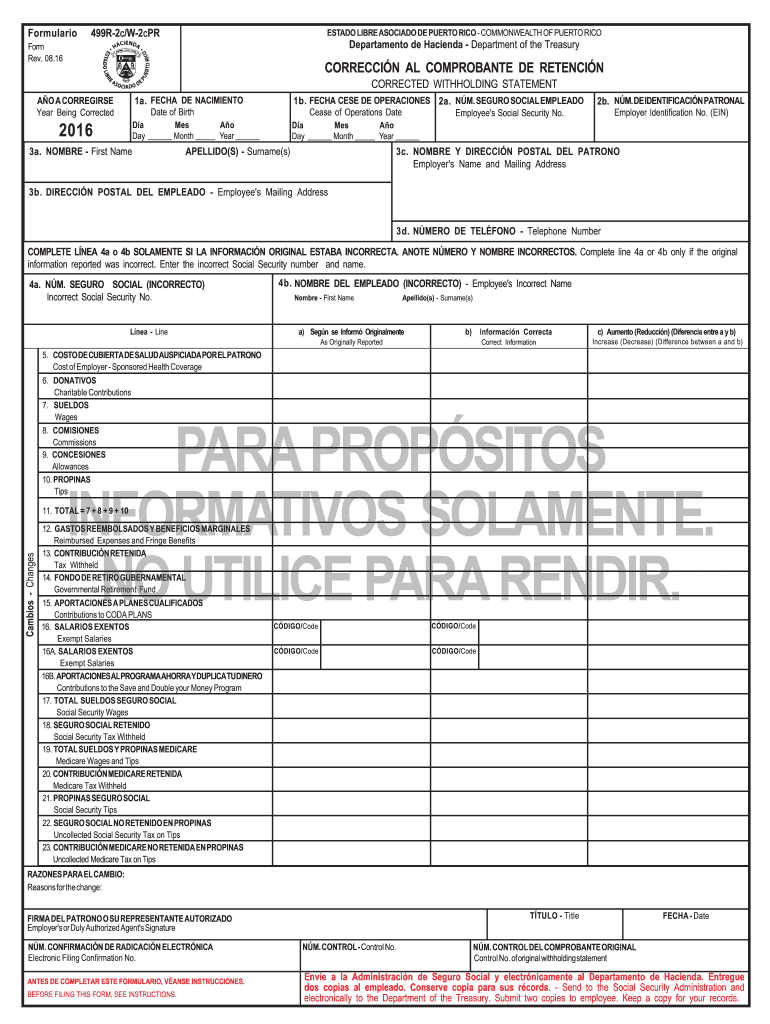

499r2/w2pr 499r2/w2pr rev 0816 rev 0816 estado libre asociado de puerto rico commonwealth of puerto rico estado libre asociado de puerto rico commonwealth of puerto rico departamento de hacienda department of the treasury departamento de hacienda department of the treasury comprobante de retenciän withholding statement. Therefore, the signNow web application is a musthave for completing and signing form 499r 2 w 2pr on the go In a matter of seconds, receive an electronic document with a legallybinding esignature Get form 499r 2 w 2pr signed right from your smartphone using these six tips Type signnowcom in your phone’s browser and log in to your account. The Form 499R2/W2PR has been revised for the 19 tax year to include new boxes to indicate if the wages being reported are related to agricultural work or to services performed by a church, minister, or member of a religious order Your yearend best practices checklist Tax season is always a busy time for Payroll and HR teams.

Withholding 499R 2 / W 2PR for employees of central government Automatic Extension of Corporations and Other Entities 12 Debt Certification for Individuals and Corporations. On October 3, 19, the Puerto Rico Treasury Department (PRTD) issued Publication 1901 to provide the electronic filing instructions for Form 499R2/W2PR What’s New Two new fields have been incorporated to the Form to indicate if the remuneration includes payments to the employee for the following services. Comprobante de retenciÓn w2 18 (formulario 499r2/w2pr) El Comprobante de Retención para el año contributivo 18 (W2) ya están disponible en el Portal UPR Para acceder el formulario siga los siguientes pasos.

Cargue los formularios 499R2/W2PR en su impresora Si tiene más de un año de datos, seleccione el año para el que desee imprimir los formularios Para incluir los empleados inactivos en la lista de empleados, seleccione la casilla Incluir empleados inactivos Seleccione los empleados para los que desea imprimir formularios 499R2/W2PR. Rate 499r 2 W 2pr as 5 stars Rate 499r 2 W 2pr as 4 stars Rate 499r 2 W 2pr as 3 stars Rate 499r 2 W 2pr as 2 stars Rate 499r 2 W 2pr as 1 stars 23 votes Create this form in 5 minutes or less Get Form Find and fill out the correct publication 18 03 signNow helps you fill in and sign documents in minutes, errorfree Choose the correct. Forms 499R2/W2PR – Withholding Statements Two new boxes were added in the general information section to indicate if the remuneration includes payments for the following payments Services provided in agricultural work – Option C.

Instructions for filing Form 499R2/W2PR Copy A (W2) information to the Department of the Treasury through electronic transfer using the MMW2PR1 format Who must use these instructions?. Para ver las instrucciones de cómo completar el comprobante de retención 499R2/W2PR, hacer clic aquí Para ver las instrucciones de cómo corregir un Formulario 499R2/W2PR ya sometido al Departamento, utilizando el Formulario 499R2c/W2cPR "Corrección al Comprobante de Retención", hacer clic aquí. 499r2/w2pr 499r2/w2pr rev 0816 rev 0816 estado libre asociado de puerto rico commonwealth of puerto rico estado libre asociado de puerto rico commonwealth of puerto rico departamento de hacienda department of the treasury departamento de hacienda department of the treasury comprobante de retenciän withholding statement.

499R2/W2PR Copy A (W2) using the EFW2PR format Users of this Publication Employers submitting Form 499R2/W2PR by text file Mandatory Electronic Filing You must file all employee wages records electronically through SURI using EFW2PR format Due Date Wage records for tax year are due February 1, 211 Register Online. COMPROBANTE DE RETENCION 499R2/W2PR MANUAL DE USUARIO Página 13 Colecturía Virtual IV Presentación del Comprobante de Retención 499R2/W2PR Para imprimir su Comprobante de Retención 499R2/W2PR oprima el botón de que se encuentra en la esquina superior izquierda. Withholding 499R 2 / W 2PR for employees of central government Automatic Extension of Corporations and Other Entities 12 Debt Certification for Individuals and Corporations.

Instructions for filing Form 499R2/W2PR Copy A (W2) information to the Department of the Treasury on magnetic media using the MMW2PR1 format Who must use these instructions?. INFORMACIÓN PARA EL SEGURO SOCIAL SOCIAL SECURITY INFORMATION Formulario Form 499R2/W2PR Rev 07 GOBIERNO DE PUERTO RICO GOVERNMENT OF PUERTO RICO DEPARTAMENTO DE HACIENDA DEPARTMENT OF THE TREASURY Fecha de radicación 31 de enero Filing date January 31 Costo de cubierta de salud auspiciada por el patrono Cost of employer. Los formularios 499R2/W2PR se obtienen en el Departamento de Hacienda Puede llamar al 721 Exts 2605, 2606, 2607, o 2608 El formulario W3PR se obtiene del IRS, o llamando al.

Your situation requires you to file two returns a Puerto Rico return and a US return. The Puerto Rico Hacienda recently released Forms 499R2 and 499R2C for Tax Year 18 These forms are the Puerto Rico equivalent of the W2 and W2c (respectively), and must be filed with the Hacienda and the Social Security Administration by every employer that has paid wages with income tax withheld for Puerto Rico (or to correct any submissions in the case of the 499R2C). Employers with 5 or more W2 Forms to submit What if I have 5 or more W2s and I send you paper W2s?.

Employers with 3 or more W2 Forms to submit using private programs, that is, any program other than our Hacienda’s web program However, employers. Modified fields The 19 Form 499R2/PR W2PR added Boxes C and D to report services rendered in agricultural labor (Box C) and services rendered by a minister of a church or religious order (Box D) Control Numbers The Puerto Rico Treasury Department has reserved the sequence between and for internal use. How do I enter WPR?.

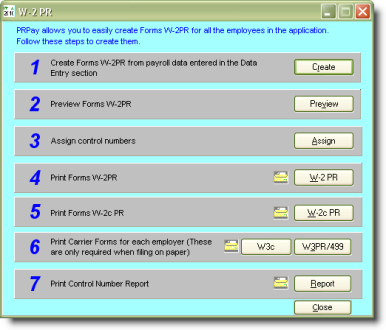

The W2PR section of the Print Preview menu allows you to create, preview, and print Forms W2PR, and create the 499R, the W3, and the Control Number reports To automatically create these files, PRPay retrieves the information from the Companies,. Puerto Rico has released Publication 1704, which contains the specifications for Form 499R2/W2PR reporting There are a number of changes from last year’s release Modified Fields Exempt Salaries Code (Box 16), (RS State Record, positions ) Blank field (RS State Record, positions ), (can be filled with blanks or zeros) Updated Reporting Requirements When. Employers with 10 or more W2 Forms to submit May I use these instructions if I have fewer than 10 W2s?.

Withholding 499R 2 / W 2PR for employees of central government Automatic Extension of Corporations and Other Entities 12 Debt Certification for Individuals and Corporations. Puerto Rico has released Publication 1704, which contains the specifications for Form 499R2/W2PR reporting There are a number of changes from last year’s release Modified Fields Exempt Salaries Code (Box 16), (RS State Record, positions ) Blank field (RS State Record, positions ), (can be filled with blanks or zeros) Updated Reporting Requirements When.

Form As Request For Extension Of Time To File The Withholding Statement 499r 2 W 2pr And The Reconciliation Statement Of Income Tax Withheld 499 R 3 14 Printable Pdf Download

2

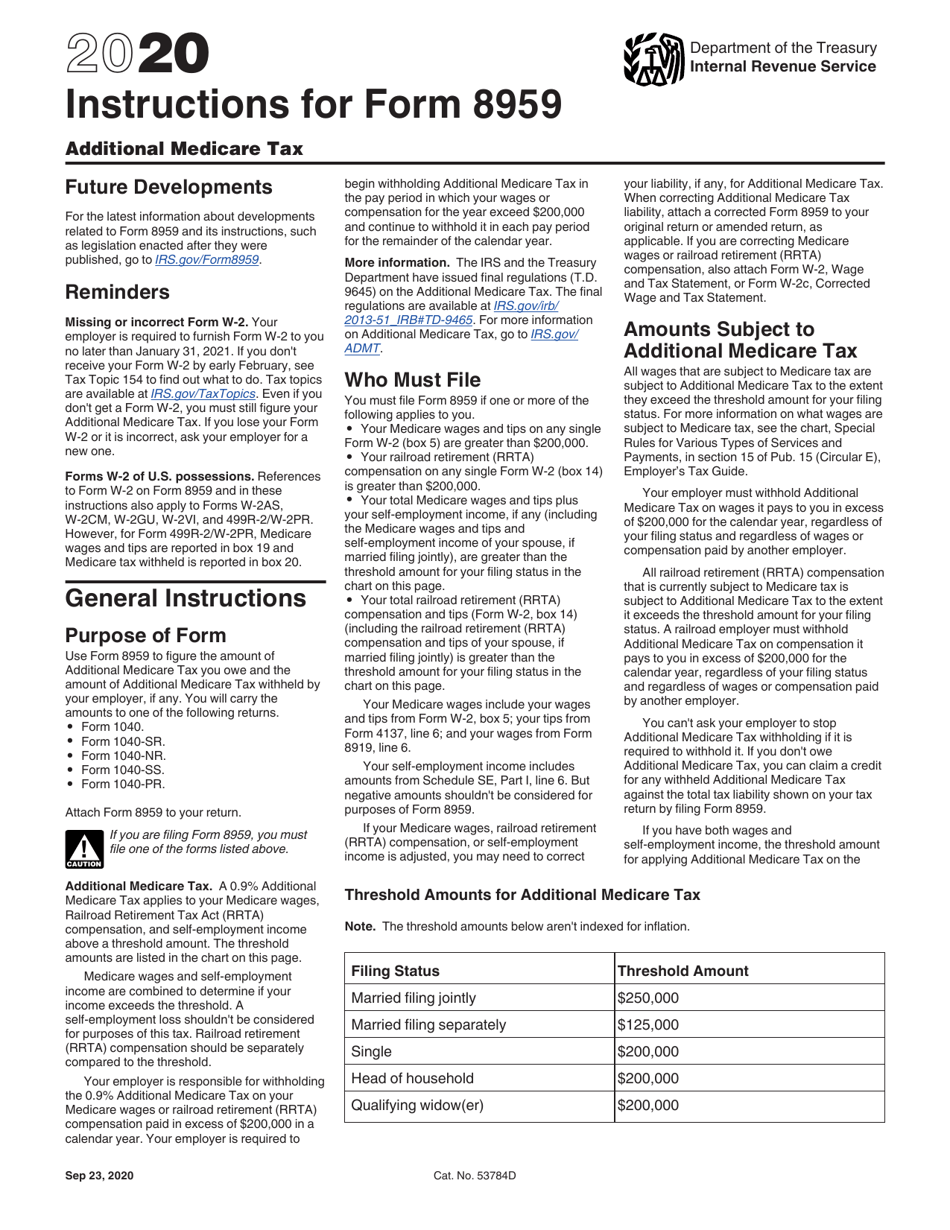

What Is Irs Form 59 How To File It A Illustrated Guide

499r 2w 2pr のギャラリー

Social Security Administration Data Operations Center Wilkes Barre Pa Solo Para Adultos En Honduras

2 1 11 Chevron Rico Filing Pdf Document

2

Withholding Tax At Source Changes In Transition To Suri Fpv Galindez Llc

Visionms Net W2showto18 Pdf

Fema Puerto Rico Photos Facebook

Www Ssa Gov Employer Efw 19efw2 Pdf

Epoca De Planillas Comprobante De Retencion W 2pr Y Formulario 480 Microjuris Al Dia

Printing Carrier Forms Paper Filing For Each Employer

Http Hacienda Gobierno Pr Sites Default Files Publicaciones 19 10 Publication 19 01 Pdf

Form W 3 Pr Informe De Comprobantes De Retencion

Tax Planning Checklist Rsm Puerto Rico

499r 2 W 2pr Fill Out And Sign Printable Pdf Template Signnow

Printing W2 Pr S For Each Employee

Setting Up Youth Wage Tax Exemption For Puerto Rico

Pdf4pro Com File 55f7a Sites Default Files W2einformativasenlinea17 Manual Pdf Pdf

New Services And Transactions On The Suri Portal

Manual Acceso Comprobante Retencion Contrasena Negocios

Paying Taxes In Puerto Rico Tax In Puerto Rico

Changes And New Items Added To The Informative Declarations Torres Cpa

Http Genesissecuritypr Com Gss Docs Instrucciones Cuenta Suri Pdf

Accounting Training Center Bien Importante Comprobantes 499r 2 W 2pr Se Pueden Radicar Sin Penalidad Hasta El 28 De Febrero De 19 Mailchi Mp Accountingtrainingpr Net Biri Facebook

Instrucciones Para El Anexo H Pr Formulario 1040 Pr Pdf Free Download

2

Form 499r 2 W 2pr Comprobante De Retencion Withholding Statement Puerto Rico Department Of The Treasury Printable Pdf Download

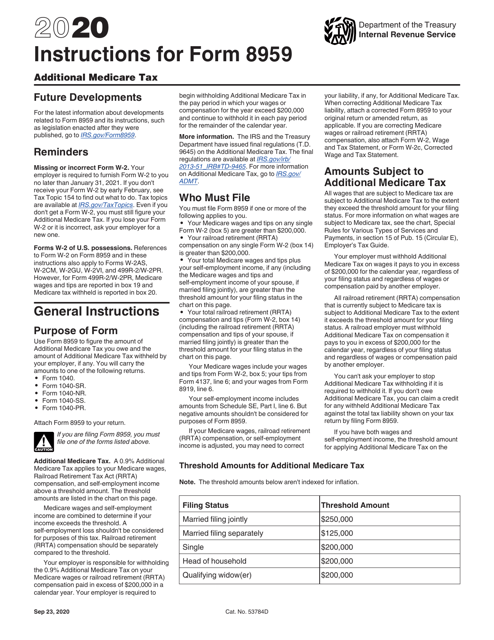

Download Instructions For Irs Form 59 Additional Medicare Tax Pdf Templateroller

Http Www Hacienda Pr Gov Sites Default Files Publicaciones 14 11 Publication 14 04 Pdf

Puerto Rico Electronic Filing Requirements Kpmg United States

Form W 3c Pr Transmittal Of Corrected Wage And Tax Statements 14 Free Download

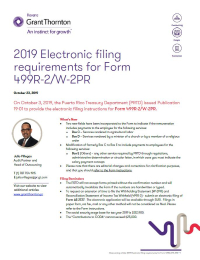

19 Electronic Filing Requirements For Form 499r 2 W 2pr Grant Thornton

Instrucciones Para El Anexo H Pr Internal Revenue Service

Http Www Hacienda Pr Gov Sites Default Files Publicaciones 17 12 Publication 17 04 Pdf

Fillable Online Form 499r 2 W 2pr Fax Email Print Pdffiller

Download Instructions For Irs Form 59 Additional Medicare Tax Pdf Templateroller

Fillable Online Form 499r 2 W 2pr Fax Email Print Pdffiller

2

Http Www Hacienda Pr Gov Sites Default Files Publicaciones 14 11 Publication 14 04 Pdf

Irs Instruction W 3pr 19 Fill And Sign Printable Template Online Us Legal Forms

Visionms Net W2showto18 Pdf

Pdf4pro Com File 55f7a Sites Default Files W2einformativasenlinea17 Manual Pdf Pdf

2 1 11 Chevron Rico Filing Pdf Document

Www Ssa Gov Employer Efw 18efw2 Pdf

Form W 3 Pr Informe De Comprobantes De Retencion Transmittal Of Wi

2

Manual De Usuario Comprobante De Retencion 499r 2 W Acceso آ Gobierno De Puerto Rico Departamento

2

About

Http Www Hacienda Gobierno Pr Sites Default Files Publicaciones 14 07 Publication 13 05 Pdf

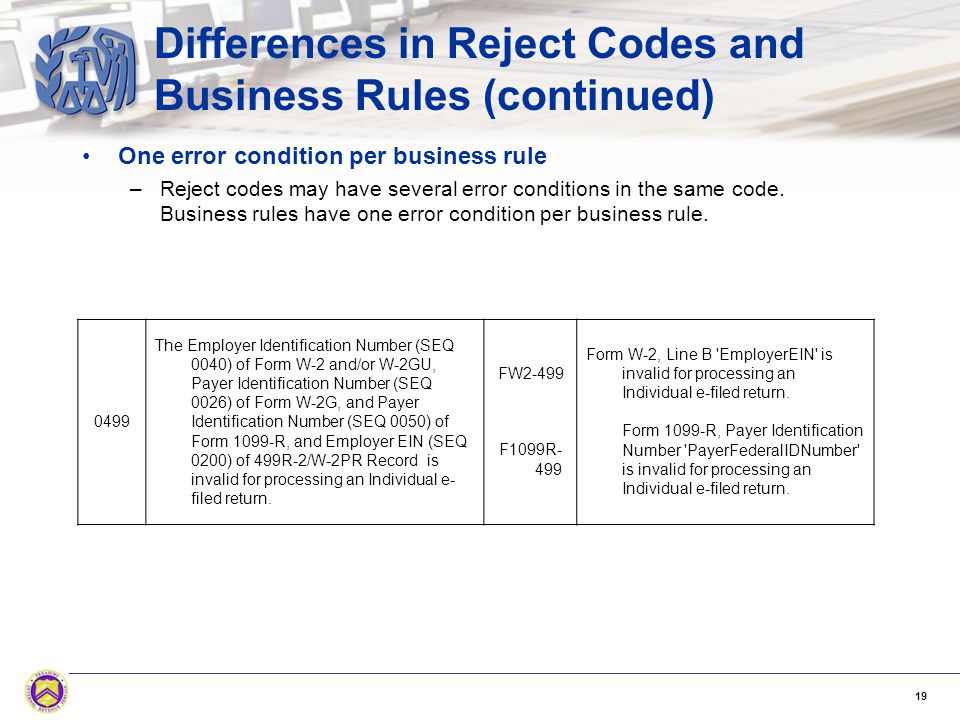

Mef Update Fta Tax Technology Conference Boise Id Internal Revenue Service Presented By Juanita Wueller A Ugust 4 Ppt Download

Cayey Upr Edu Wp Content Uploads Sites 10 04 Cayey Instrucciones Para Obtener La W 2 Pr E Informativas Suri Pdf

W2 De 17 Tiempo Extraordinario Retencion De Impuestos

Dpto De Hacienda V Twitter Patrono Recuerda Que Los Comprobantes De Retencion 499r 2 W 2pr Mejor Conocidos Como Las W 2 Y Su Estado De Reconciliacion 499r 3 Correspondientes Al Ano Contributivo 19 Deben Someterse Electronicamente

Miperfil Colegiocpa Com Download Php Id

Form 499r 2 W 2pr Copy A Electronic Filing Requirements For Tax Year 16

311prkb Respondcrm Com Haciendadocs Formularios 13 Formularios 13 Pdf

Formulario W 2pr W 2c Para Formulario De Presentaci Oacute N Electr Oacute Nica W2pr En L Iacute Nea Software W2pr

2

Gobierno De Puerto Rico Departamento De Hacienda Manual De Usuario Comprobante De Retencion 499r 2 W 2pr En Colecturia Virtual Rev Pdf Free Download

2

Manual De Usuario Comprobante De Retencion 499r 2 W Acceso آ Gobierno De Puerto Rico Departamento

P179 Publicacin 179 Contenido Circular Pr Qu Hay De Nuevo Cat No w Department Of The Treasury Internal Revenue Service Gua Contributiva Federal Course Hero

Fillable Online W 3pr 12 Form Fax Email Print Pdffiller

Http Www Vgmmcpa Com Images Tax Alert 16 03 Pr Department Of Treasury Issues New Withholding Statement And Informative Return Forms Pdf

Form W 3 Pr Informe De Comprobantes De Retencion Transmittal Of Wi

Formulario W 2pr W 2c Para Formulario De Presentaci Oacute N Electr Oacute Nica W2pr En L Iacute Nea Software W2pr

Thrupike It S Like Getting Your Back Office For Free

2

Cayey Upr Edu Wp Content Uploads Sites 10 04 Cayey Instrucciones Para Obtener La W 2 Pr E Informativas Suri Pdf

2

Form 480 Puerto Rico Page 1 Line 17qq Com

2cpr Fill Out And Sign Printable Pdf Template Signnow

Comprobantes De Retencion W2 499 R 2 W 2pr La Isla Oeste

New Extended Due Dates For 19 Tax Returns As Result Of The Covid 19 Emergency Fpv Galindez Llc

Http Www Hacienda Pr Gov Sites Default Files Publicaciones 19 10 Publication 19 02 Pdf

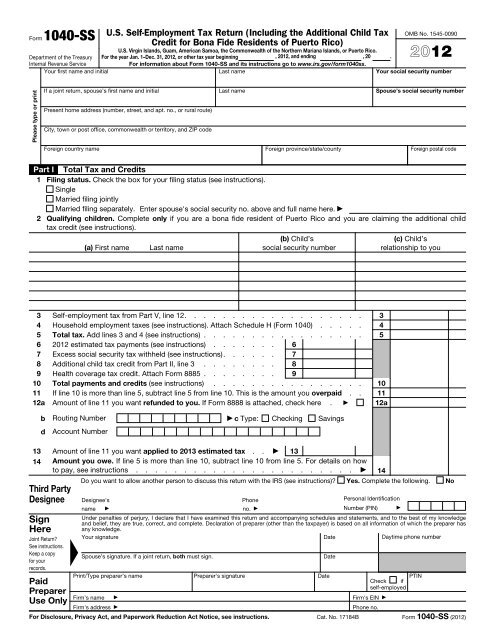

Form 1040 Ss U S Self Employment Tax Return Form 14 Free Download

Instrucciones Para El Anexo H Pr Internal Revenue Service

Fill Free Fillable Form W 3pr Informe De Comprobantes De Retencion 17 Pdf Form

Ano Year Comprobante De Retencion

Payroll Tax Season Preparation

Printing Carrier Forms Paper Filing For Each Employer

Http Www Hacienda Gobierno Pr Sites Default Files Publicaciones 16 12 Publication 16 04 Pdf

Electronic Filing Requirements For Forms 499r 2 W 2pr Grant Thornton

Nuevos Servicios Y Transacciones Es Suri Pdf Free Download

Fillable Online Form 499r 2 W 2pr Fax Email Print Pdffiller

Modelo Sc 27 Departamento De Hacienda De Puerto Rico

Form 499r 2 W 2pr Copy A Electronic Filing Requirements For Tax Year 16

Http Www Hacienda Gobierno Pr Sites Default Files Publicaciones 18 11 Publication 18 03 Pdf

Http Www Hacienda Pr Gov Sites Default Files Publicaciones 17 12 Publication 17 04 Pdf

Form W 3 Pr Informe De Comprobantes De Retencion Info Copy Only

Assets Kpmg Content Dam Kpmg Us Pdf 19 10 194 Pdf

W 2 Pr

Eformrs Com Forms09 Fedpdf09 4137 Pdf

Form 499r 2 W 2pr Fill Online Printable Fillable Blank Form W 3pr Com

Puerto Rico Releases 17 Specifications For Form 499r 2 W 2pr Reporting Sovos

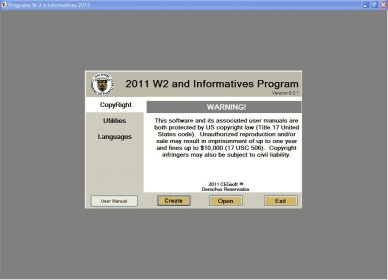

11 W 2 And Informative Returns Program Download This Program Generates Files With The Information Of The Withholding Statements

12 Form 1040 Ss Internal Revenue Service

Miperfil Colegiocpa Com Download Php Id